How is the Cheque Score Calculated?

Benefits for Cheque Receiver

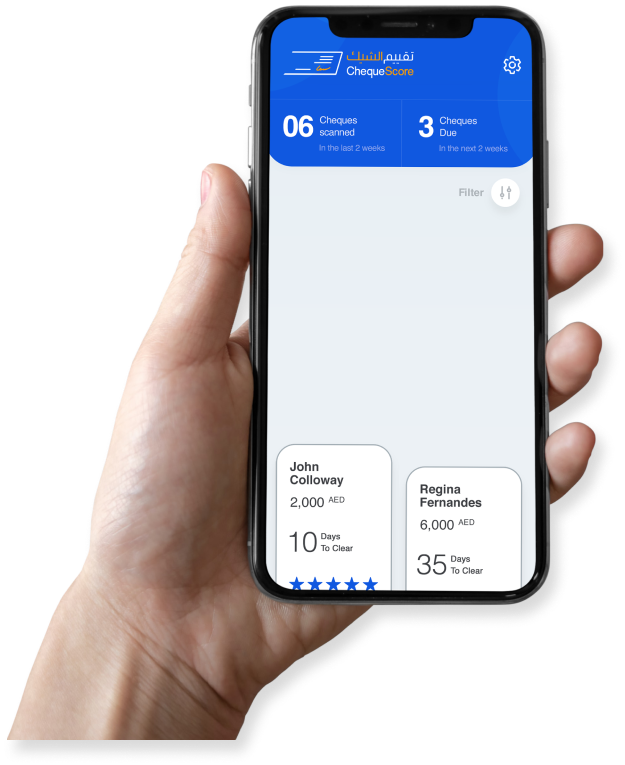

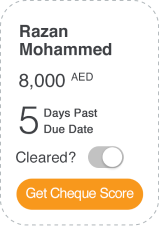

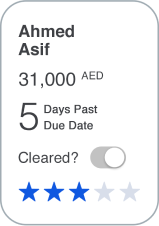

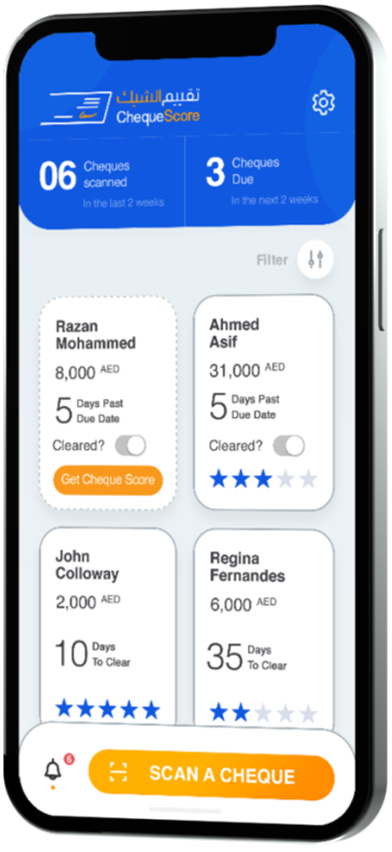

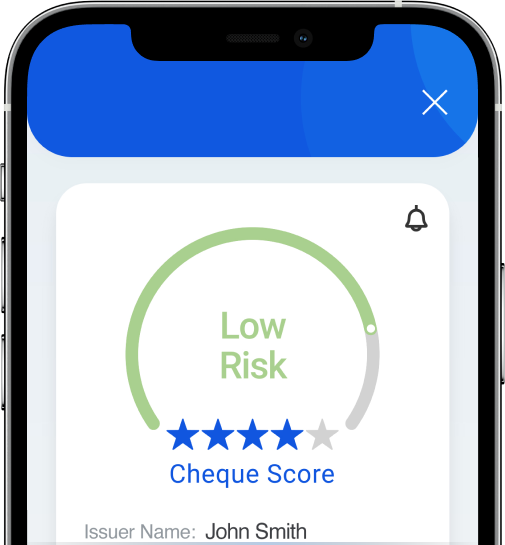

Knowing the possibility of a cheque to bounce is a critical information that Cheque Score can provide upfront, supporting the receiver to take a more informed decision on whether to accept or not a cheque as a method of payment.

Cheque Score is particularly valuable to Small and Medium Enterprises (SMEs), offering a simple tool to maintain stable cashflow.

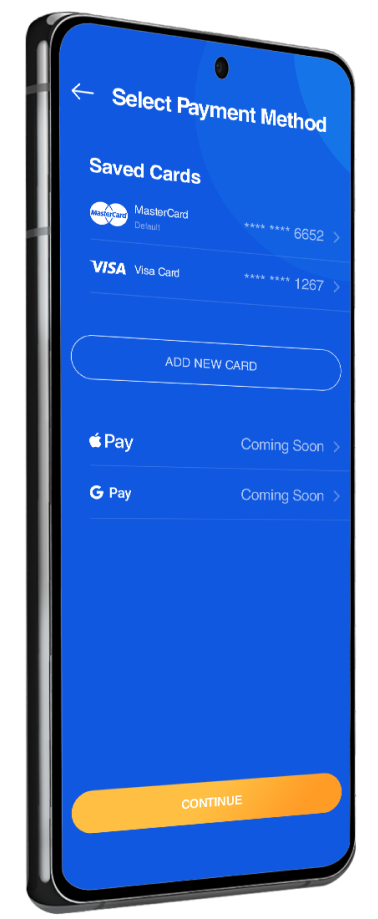

Get your Cheque Score now

For an optimal experience, please rotate your device to portrait mode.

For an optimal experience, please rotate your device to portrait mode.